Asia’s Shrimp Connoisseurs: Japan, Taiwan And South Korea

Niche markets in Asia are said to be hard to crack as they’re highly specialized and cater to a particular market segment with specific needs. However, once you manage to enter these markets, there are plenty of opportunities for your shrimp products. In this article, we’ll explore three niche markets in Asia that have growing potential for imported shrimp: Japan, Taiwan and South Korea.

Japan: an affinity with shrimp based on history

Being the third largest market for fish and seafood in the world, Japan traditionally has a great affinity with seafood. Chilled, raw packaged fish and seafood and fresh fish remain the most popular items in Japan, more so than the frozen or dried varieties. Remember that Japan also produces its own fish and over 90% of production is consumed domestically.

The consumption of seafood – including shrimp – has long been embedded in Japanese culture. Being an island nation with mountainous landscapes and limited agricultural space, the Japanese turned to the sea as a primary source of protein. Today’s demand for seafood is, thus, rooted in its long-standing seafood culture. Another influential factor is Japan’s aging population. The senior population are accustomed to eating shrimp products. They also value food safety and quality over price. And – interestingly – this strong tradition of seafood consumption is passed down to subsequent generations: Japanese children have huge respect for customs and traditions, and are also, therefore, highly likely to follow this trend and incorporate seafood into their daily diets later on in life.

The Japanese also consume their seafood based on seasonality: fatty fish – such as cod, salmon and tuna – is consumed more in winter. While shrimp is consumed year round, it’s promoted more during the spring and summer seasons due to its vibrant pink colour, which has a logical association with the Sakura (or “cherry blossom”) season.

Due to this long history of seafood consumption, Japanese consumers know their shrimp, and they’re perceived to be among the world’s most demanding consumers regarding product quality and freshness. They also understand that such requirements come with a price tag: fresh, good-quality seafood entails fast and efficient transportation and complex distribution channels. These factors contribute to making imported shrimp products more expensive, yet buyers Are tolerant of the high prices: in general, Japanese buyers are willing to pay for top quality and freshness. But, more recently, certain categories of consumer – particularly the younger generation – have been seeking lower-priced products and more convenience items.

Sushi Ebi

This can be attributed to their apparent lack of cooking skills when compared to other generations, and their busier lifestyles.

Convenience is clearly a very important factor in modern Japanese culture. You can see evidence of this all over the food world, from the bite-sized umami sushi and the playful, ready-to-eat bento boxes, to the 24/7 Konbini convenience stores that are located all over the country.

In Japan, shrimp, which is also known as “Ebi” (mostly Pacific white shrimp or L. Vannamei), is largely purchased as headless shell-on (HLSO). However, demand for head-on shell-on (HOSO) shrimp becomes strong during New Year celebrations and traditional family dinners at home. One of the most popular ways to consume shrimp is in sushi and sashimi. “Sashimi” refers to different kinds of raw fish and meat while “sushi” is a combination of sashimi and vegetables wrapped in rice. Another popular way to eat shrimp is Nobashi Ebi: peeled and deveined (PD), tail-on and stretched shrimp used to make tempura. Today, more value-added items are present in the market, including items like ready-to-eat shrimp pizza, shrimp balls or shrimp-based soup. Other species like black tiger shrimp (P. Monodon) are also becoming increasingly popular, particularly as they become more affordable for the average consumer.

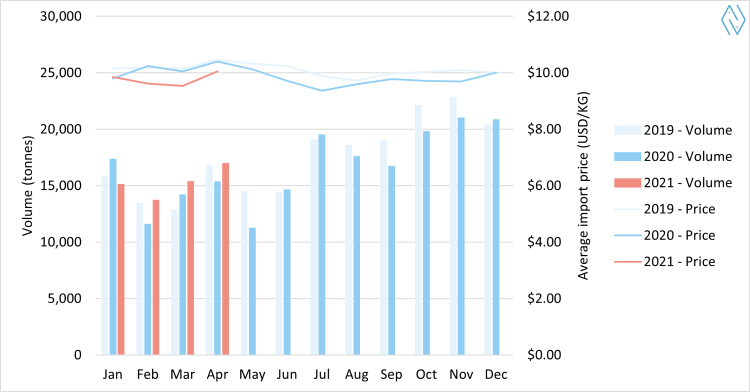

Shrimp imports of Japan from 2019 to 2021

Source: Japanese Ministry of Finance Statistics

Demand and outlook

In terms of imports, Japan presents a special opportunity for shrimp exporters. In 2020, overall imports declined by 5% from 209,793 tonnes in 2019 to 199,808 tonnes. This was attributable to the impact of the COVID-19 pandemic in both the domestic market and supplying countries. However, in 2021, this has slowly been improving, with a 4.6% increase on the year-to-date volume (61,165 tonnes). Prices remained lower compared to 2020.

Frozen products are the main type of shrimp products imported by Japan with a total of 137,751 tonnes imported in 2020. Value-added products are also in demand at 62,058 tonnes imported in 2020. Japanese importers mostly source their shrimp from Vietnam (27%), India (19%), Indonesia (16%), Thailand (15%), and Argentina (8%).

Over the last year, due to the various restrictions caused by the global pandemic, home consumption has increased for semi-processed and processed shrimp. Supermarket and online sales of ready-to-cook shrimp and meal kits as well as (restaurant) takeaway meals also increased. Demand was strong for products such as fried tempura shrimp, PD shrimp, frozen mixed seafood with rice or pilaf, and ready-to-fry tempura shrimp during the spring and summer months.

Japanese imports of shrimp are expected to pick up as COVID-19 cases decrease and vaccinations push forward. But major cities like Tokyo, Hokkaido, Osaka and Fukuoka are currently under a state of emergency – regulations are expected to be lifted by end of June. Meanwhile, restaurants and bars are still being asked to operate with reduced hours. With the Olympics planned to take place in July in Japan, consumption of seafood is expected to increase, but the government is still considering implementing a quasi-state of emergency to avoid a surge in COVID-19 cases.

Taiwan: mixing business with pleasure

Taiwan is an island country in Southeast Asia and neighbours Japan. Like the Japanese, the Taiwanese also have a great affinity with seafood, and have a particular preference for high-quality products. What’s more, “[t]he Taiwanese prefer the product packaging to be compact, beautifully designed and with full instructions”, according to an article by the Vietnam Association of Seafood Exporters (VASEP), also revealing something about their preferences for quality products.

This market has seafood consumption habits influenced by both China and Japan, but to fully understand Taiwan, we must also consider its history and tradition as a shrimp producer itself.

Shrimp production, together with milkfish farming, goes back to the 1960s during the “blue revolution”: when fishermen caught milkfish fry along the coast, they also ended up catching shrimp larvae, which was then thrown into ponds and cultured until they reached the desired size. Around the 1970s, Taiwan became an important producer of shrimp, but large-scale production has not been maintained due to a series of environmental problems, as well as contamination and disease outbreaks.

Nevertheless, shrimp still holds a special place for the Taiwanese making it an interesting market for exporters. Today, their relationship with shrimp also extends to recreational fishing: individuals catch their own shrimp, cook it, and enjoy it with family and friends.

While shrimp production is still strong today, it’s mostly consumed domestically and there remains a gap between domestic production and demand. To meet the demand for shrimp, imports have been growing in recent years, making it a promising “niche” market in Asia. Most imported shrimp is consumed at traditional wet (seafood) markets or enters the food service sector destined for restaurants, for example. But it is also sold to supermarkets and retail chains. “Most Taiwanese people like to cook and consume HOSO shrimp. That’s why HOSO black tiger shrimp and cooked HOSO Pacific white shrimp are still the main items. However, the younger generation is continuously looking for convenience items such as cooked and peeled shrimp”, Yen-wei Tai told us, who represents a group of importers from Taiwan.

Let’s dive into the details and look at the numbers.

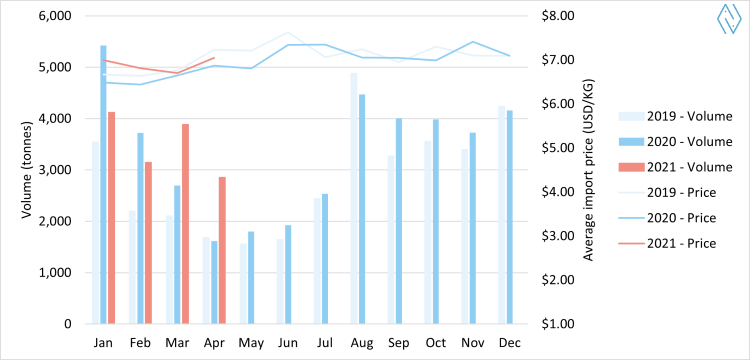

Shrimp imports of Taiwan from 2019 to 2021

Source: Custom Administration, Ministry of Finance in Taiwan

Demand and outlook

In 2020, Taiwan imported a total of 40,081 tonnes, 16% more than it imported in 2019, showing the growing potential in imports despite the impact of the COVID-19 pandemic. In Q1 of 2021, the volume imported by Taiwan fell by 5%. The import stats for April 2021 are, however, showing an upward trend and volumes rose significantly year-on-year: imports reached 2,855 tonnes, a 76% increase over April 2020. Import prices also rose to $7.05/kg.

The top five exporters to Taiwan are Honduras (30%), Nicaragua (25%), Malaysia (10%), Thailand (9%) and Vietnam (7%). Taiwan has diplomatic relations with Nicaragua and Honduras where import taxes are exempted, thereby making it a favourable choice for Taiwanese importers.

Taiwan imports most of its frozen Pacific white shrimp from Central American countries such as Honduras and Nicaragua. Frozen or fresh whole, butterfly, frozen meat and frozen peeled undeveined (PUD) black tiger shrimp are usually sourced from Asian countries such as Vietnam. Taiwan also imports frozen Pacific white shrimp, Nobashi Ebi, and other frozen value-added products from Vietnam.

Taiwan mostly imports Pacific white shrimp, but the population also likes black tiger shrimp: in 2020, 32,274 tonnes of Pacific white shrimp and 3,817 tonnes of black tiger shrimp were imported. According to one importer, exporter and processor, most of the shrimp imported is in the form of cooked HOSO shrimp (50%), raw HOSO shrimp (20%) or PD shrimp (20%) while the rest is in value-added form. This includes Sushi Ebi, Nobashi Ebi or Panko Ebi (coated with breadcrumbs and fried). Meanwhile, around 50% of black tiger shrimp is imported raw HOSO.

Over the last year, Taiwan has managed to curb the resurgence of COVID-19 cases with strict border controls and contact tracing. However, recent outbreaks have forced the government to issue strict restrictions including the closure of restaurants. With strict lockdowns issued, it’s likely that people will turn to home cooking and consume more frozen shrimp products. Traditional wet markets have also been impacted due to shortened opening hours – the public is also being encouraged to limit visits to them – and they’re therefore offering mostly takeaway and delivery services. While cases are slowly stabilizing, the situation still causes concern for many consumers, and this affects overall dining habits.

South Korea: quality and convenience rule

Shrimp is an important part of the food culture in South Korea. In cities like Seoul or Gangnam, luxury all-you-can eat shrimp buffets are popular. Many South Koreans also enjoy a bowl of shrimp hotpot on a cold winter’s day. Frozen shrimp is, in fact, the leading seafood product imported by South Korea, followed by frozen Alaska pollock, fresh salmon and frozen squid. Between 2015 and 2019, the compound annual growth rate (CAGR) of imports of frozen shrimp and prawns was 7%. The dependence on imports also grew due to domestic and regional constraints in production.

Breaded Shrimp

South Korea has one of the strongest economies in the world: it has the 4th largest GDP in Asia and the 10th largest in the world. South Koreans have high disposable incomes, making them willing to pay more for high-quality and convenience products. Demand for seafood has also been growing as more and more consumers associate seafood with being healthy.

“Quality is the most important aspect. Inspections and national quarantine agencies have been very strict about imported fishery products, and importers are very careful who they deal with from the export side”, one importer said. This is also something that reassures consumers: with strict health certification requirements for imported seafood, consumers consider it to be a clean, trustworthy and healthy product that has passed strict controls.

South Korea is an interesting yet hard market to enter due to several factors: there is close contact between importers and exporters, meaning that trust is a major criterion in any business deal in South Korea. What’s more, the Korean business culture is notoriously tricky to navigate, as personal recommendations, references and reliability are all important elements.

“The Korean market has an amazing opportunity for HOSO but it’s tough to crack. There’s a saying that if your product is good for South Korea, it is good for the world”, one exporter told us.

So where is seafood, and specifically shrimp, consumed in South Korea? South Koreans like to purchase their shrimp at traditional wet markets and it’s also – mostly – destined for the food service sector. Due to the significant influence of Japanese culture on South Koreans, the consumption of sushi and sashimi is also huge and growing.

In addition, retail stores sell individually packaged sushi and prepared or semi-prepared fish and seafood in their chilled product aisles for consumers looking for that extra bit of convenience. When buying shrimp at the grocery store, South Koreans are very mindful of the origin of the shrimp as they usually associate quality and trust with origin. This means that sustainability certification is becoming increasingly popular due to its association with reliability and safety.

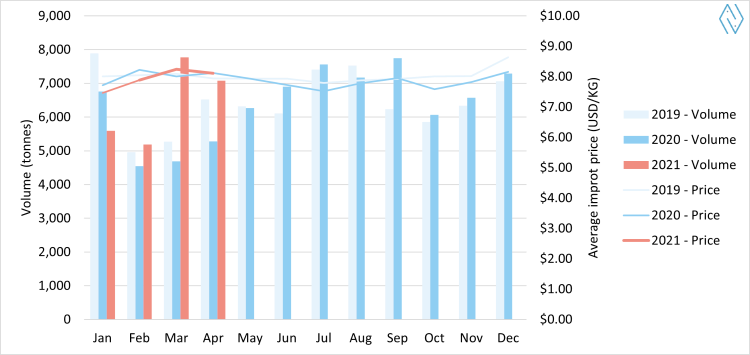

Shrimp imports of South Korea from 2019 to 2021

Source: Korea Customs and Trade Development Institute (KCTDI)

Demand and outlook

In 2020, South Korea imported 76,845 tonnes, slightly lower than in 2019 which reached 77,472 tonnes. The decrease may be attributed to the impact of COVID-19 on imports, as well as on exports from supplying nations. However, looking at the trend since 2016, imports have been on the rise. The five main exporting countries to Korea are Vietnam (53%), Ecuador (11%), Peru (7%), Thailand (7%) and China (5%).

Demand for imported shrimp falls mostly into two categories: the HOSO either goes into traditional seafood markets (such as wet markets) or into the processed shrimp market (mostly retail and e-commerce channels). South Korea sources a large portion of its HOSO Pacific white shrimp products from Latin American countries, primarily from Peru and Ecuador, and from some Asian countries such as Malaysia and Thailand. Processed products and other value-added items used for sushi or tempura-making are sourced from Vietnam or India.

Large Pacific white shrimp sourced from Peru or Ecuador is the most consumed species. However, there is also a market for black tiger shrimp, Argentine red shrimp (P. Muelleri), and wild-caught black tiger shrimp which is referred to as “sea tiger”. The important thing to remember is that the shrimp should be big (30/40, 40/50, 50/60 count) and brightly coloured (A3-A4) for the South Korean market as customers usually associate these traits with freshness and good quality. However, there’s also demand for lower quality shrimp such as A2, which is in demand by the processed shrimp market, found mostly in retail and e-commerce.

“In Korea, we normally consume HOSO, raw tail-off PD, raw peeled deveined tail-on (PDTO) and value-added products such as breaded shrimp or sushi-topping shrimp items. Customers usually don’t want to buy HLSO due to the perception that it’s of a lower quality”, a representative of CHC-King, an importer in South Korea said.

Big importers that specialize in seafood usually buy many containers and sell them to wholesalers and distributors. The wholesalers and distributors then supply these products to restaurants, retailers, domestic food markets and traditional wet markets where they’re sold on to consumers. However, with e-commerce playing an increasingly important role in South Korea, importers are also selling them directly to e-commerce platforms such as Gmarket, Auction, Interpark or Lotte.

Currently, e-commerce is booming in South Korea as restaurant and buffet-style dining out has significantly decreased due to the global pandemic. Meal kits are becoming popular as more and more consumers look for easy ways to prepare food at home. Currently, all restaurants are open to revitalize the economy but only until 10 p.m. After that, only delivery is possible. As only about 10% of the South Korean population has been vaccinated, the country’s economic recovery may not be as quick as elsewhere, and this may impact seafood – including shrimp – demand.

Asia’s shrimp connoisseurs

The “niche” markets of Japan, Taiwan and South Korea may represent a smaller share in the market when compared to large importing nations. However, their specific demand for high-quality products, combined with a long history and affinity with seafood in general, makes these countries attractive for many exporting nations that are able to match their demanding requirements. Due to this, prices and demand are also generally stable.

To understand these markets, it’s important to pay attention to and respect their history and consumption patterns. In Asia, understanding these nuances is highly valued as traditions play an important part in the culture of consumers and buyers. This translates into actual purchasing habits. In all of these markets, keep in mind that visuals and presentation play an important part too. Though these markets may differ in terms of their volumes, prices, demand and structure of the supply chain, there is one thing that binds them together: their love for shrimp.

Source: seafood-tip.com

Other news

- A recovery for the shrimp market? 17/04/2024

- Shrimp market: Fear of inflation and declining demand 22/10/2022

- Summer demand remains strong in the United States of America and Europe 08/11/2021

- Global supply chains are being battered by fresh COVID surges 18/08/2021

- Animal Health and Welfare in Aquaculture 17/08/2021

- Pangasius Imports Outpacing Tilapia 10/08/2021

- Growth in India's Shrimp Production and Exports 08/08/2021

- Decline in shrimp exports to China makes shrimps cheaper in India for domestic market 03/08/2021

- Rabobank sees plenty of positives for both shrimp and salmon sectors 29/07/2021

- Latest Vannamei in India update 01/07/2021