US shrimp imports continued surge three months into pandemic, NOAA data shows

US shrimp imports continued surge three months into pandemic, NOAA data shows

By Jason Huffman May 5, 2020 18:43 BST, undercurrentnews

Charts contributed by María Feijóo

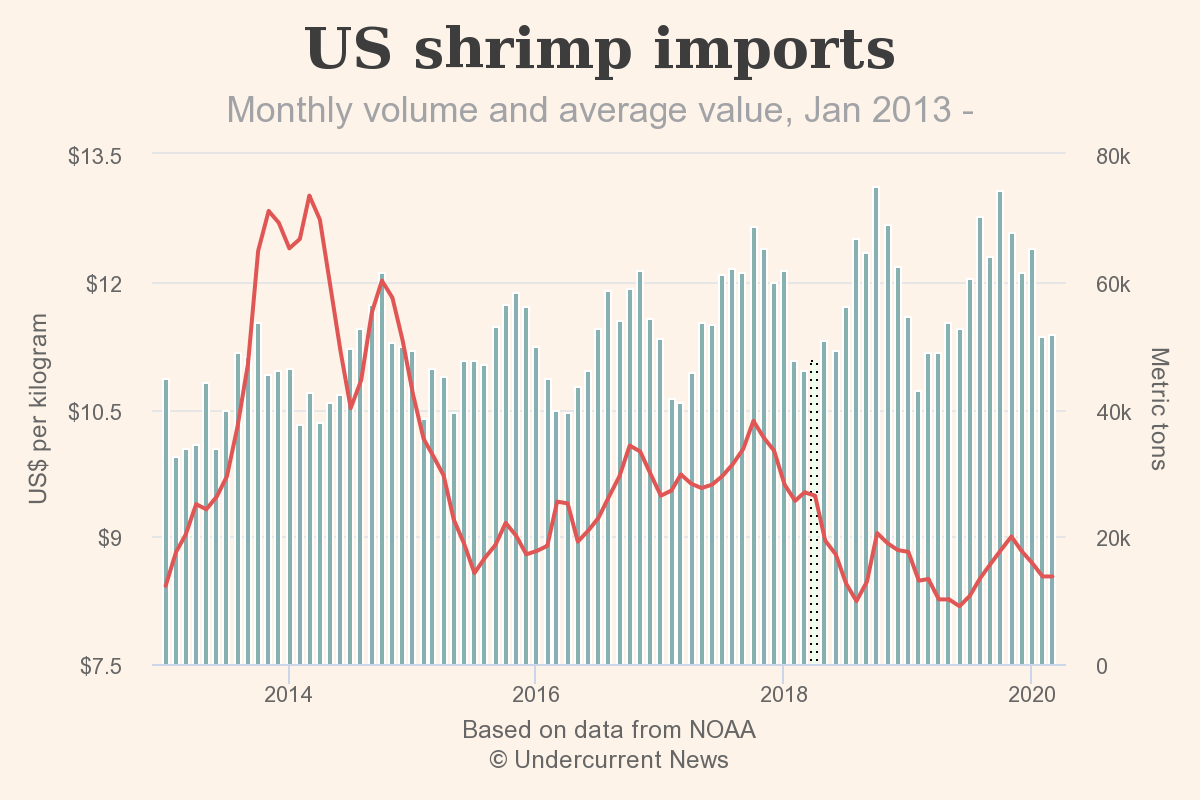

Relax if you feared the next update of seafood trade data would show a dramatic change in the volume and value of US shrimp imports due to the drop in the economy, the closing of restaurants and the loss of international flights.

It didn't happen. Rather, the US bought 51,908 metric tons of shrimp worth $442.8 million during March, a 6% increase in both volume and value compared to the same period in 2019, the National Oceanic and Atmospheric Administration’s March trade data shows.

That’s even more shrimp than in February 2020, when the US imported 51,564t worth $439.7m.

The average overall price in March 2020 was $8.53 per kilogram, the same as in February but $0.03 more than paid in March 2019.

All three of the US’ top shrimp import sources – India, Indonesia and Ecuador – saw bigger numbers in shrimp exports to the US.

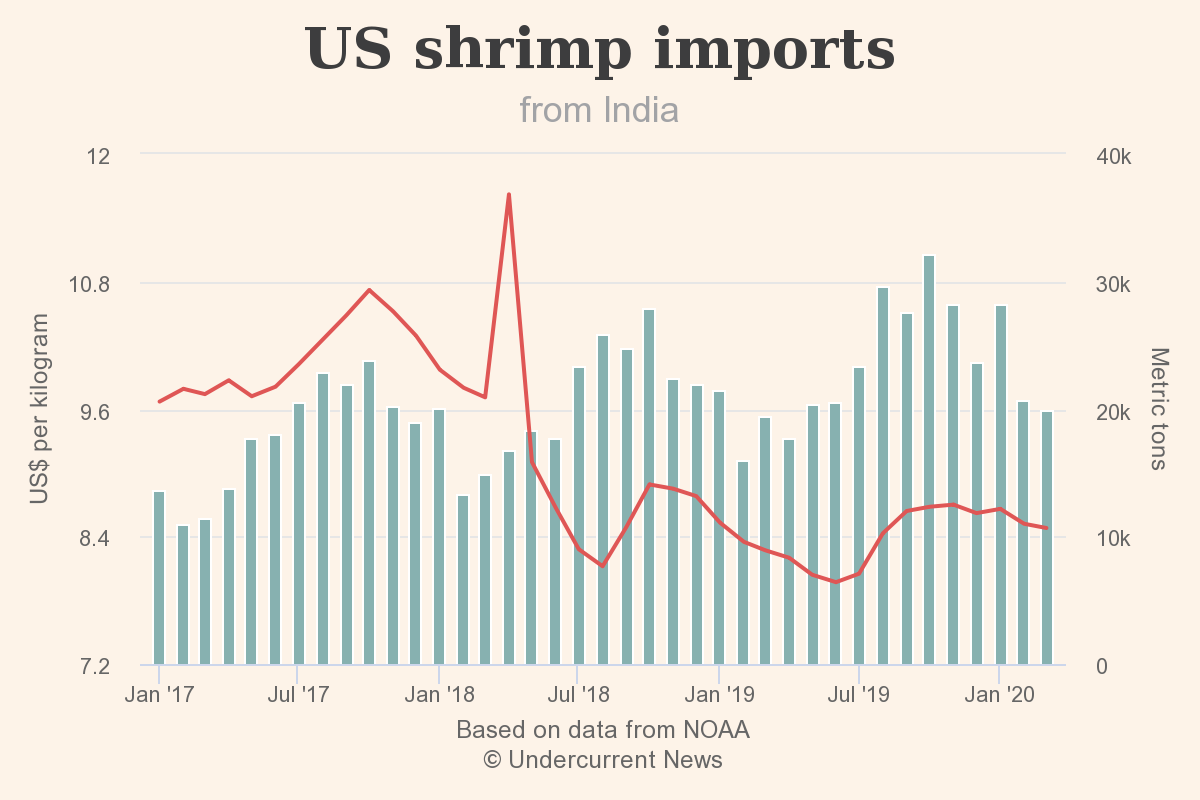

India sent the US 19,924t of shrimp worth $169.0m in March 2020, an increase of 3% in volume and 5% in value, and even saw a better average price of $8.48/kilo, $0.20 more than the same month in 2019. As usual, India accounted for the largest share (38%) of US shrimp import volumes in March.

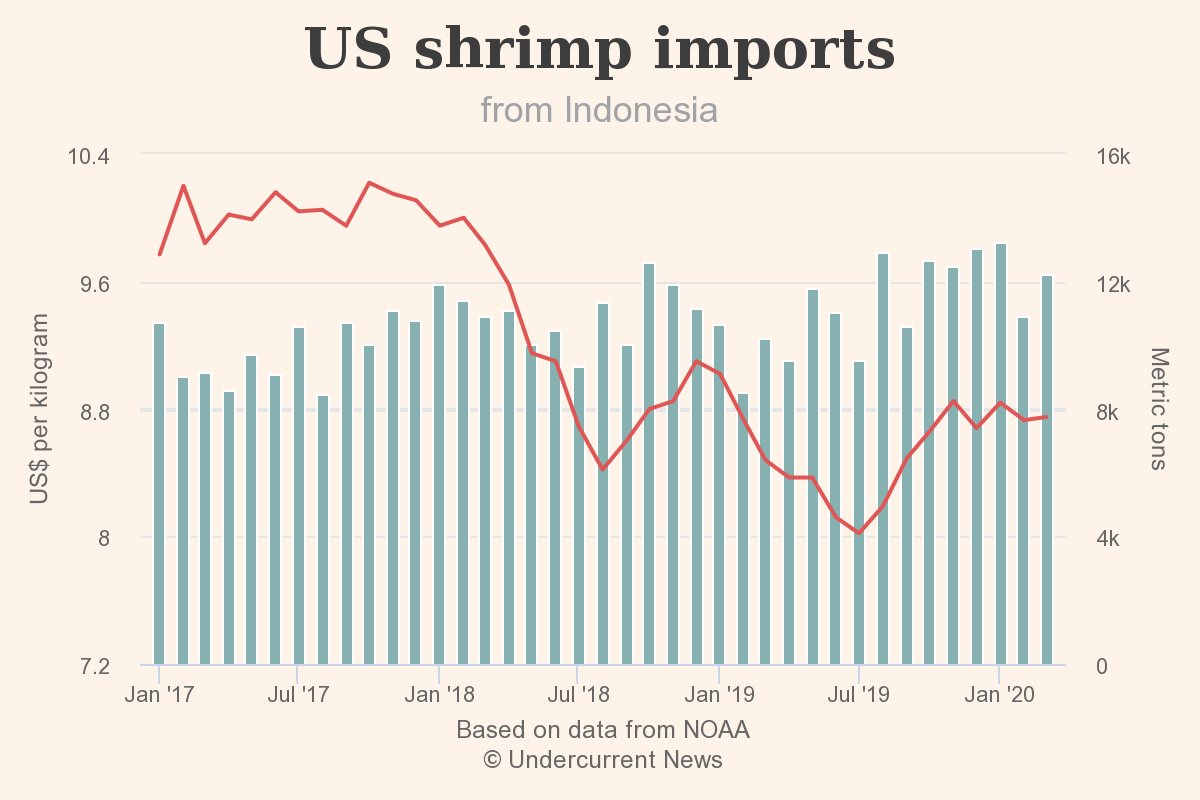

The US’ second-biggest source of shrimp, Indonesia, sent it 12,208t of shrimp (24% of all shrimp) worth $106.9m in March 2020, an increase of 20% in volume and 23% in value, and saw its average price spike to $8.75/kilo, $0.26 more than the same month in 2019.

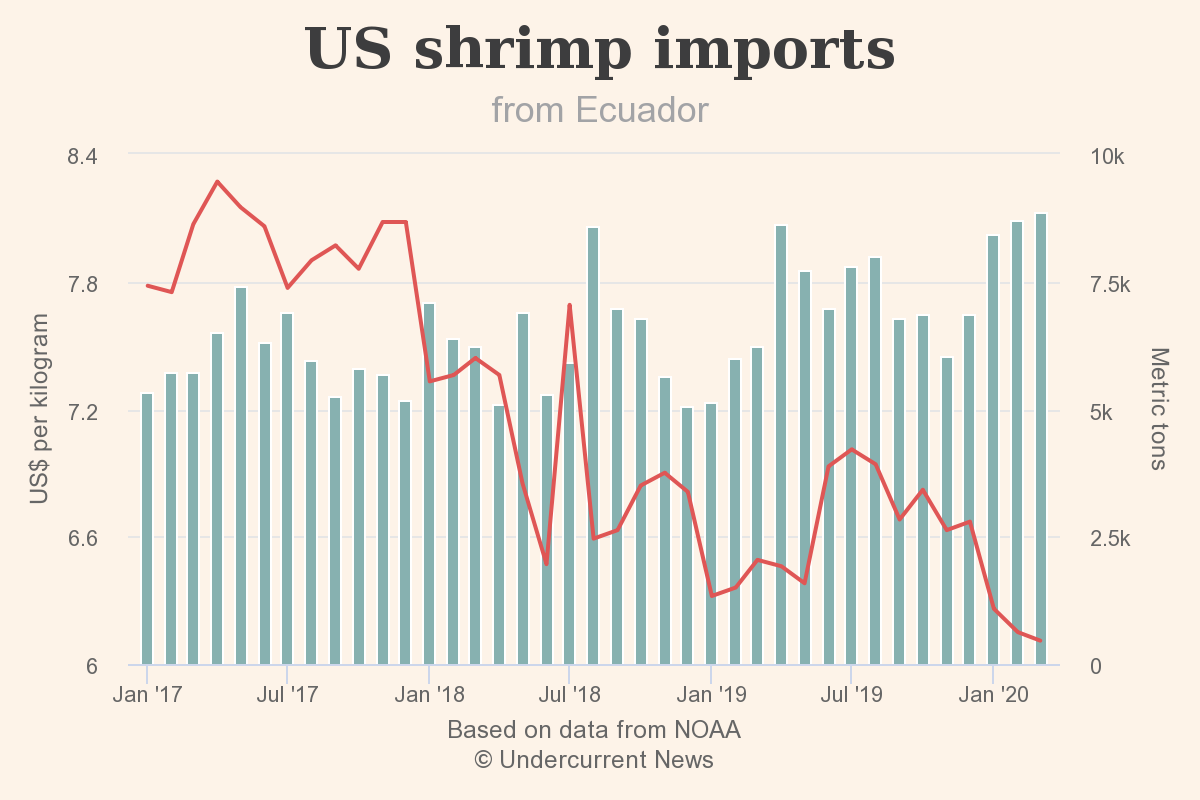

Ecuador sent the US 8,882t of shrimp worth $54.3m in March 2020, a whopping increase of 43% in volume and 35% in value, but the price was $6.12/kilo, down 6% from the same month in 2019.

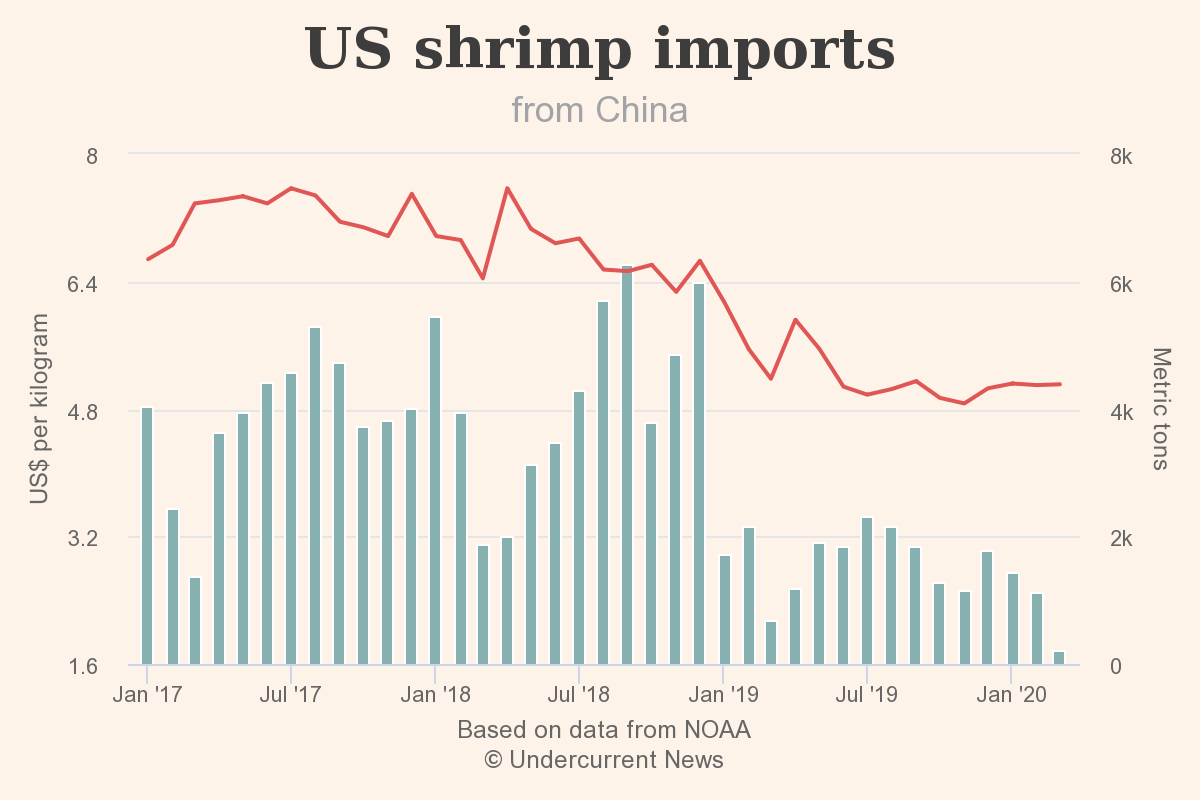

Way down in March 2020, as might have been expected, were US shrimp imports from China. The double whammy of the US-China trade war and coronavirus saw China send the US just 206t worth $1.1m, down 70% in both volume and value. Chinese shrimp garnered an average $5.11/kilo, down 8 cents from March 2019.

More trouble ahead

The better overall numbers for shrimp imports as late as the month of March might be a surprise given that many US states in mid-March ordered their restaurants to close, allowing only delivery and take out orders. Many importers and wholesalers began attempting to convert their operations to sell more to retail, where demand has remained hot but requires different packaging.

As Jeff Sedacca, CEO of the Sunnyvale Seafood Company, a Union City, California-based division of China’s Zhanjiang Guolian Aquatic Products, explained to Undercurrent News in late March, while shrimp is typically packed for foodservice in boxes of six four-pound bags, headless but shell on, it instead goes in one to two-pound bags for retail. Factories don’t have the workers needed right now to convert shrimp to EZ peel, he warned.

“Few plants can handle that kind of thing right now because they are either overloaded with their own work or they are short of staff,” he said.

But a future drop in shrimp imports should be expected, given the many circumstances now in play.

India, on May 1, extended its five-week nationwide lockdown by another two weeks, until May 18. The state government of Andhra Pradesh -- the hub of India's shrimp industry -- has set a maximum price for post-larvae (PLs) shrimp from hatcheries among other measures, as it also looks to help facilitate the movement of broodstock.

According to a state missive shared with Undercurrent by Sudhakar Velayutham from the Indian aquatech and data service company Aquaconnect, the state government has enforced a maximum price of INR 0.35 ($0.0046) per PL, with shortages expected in the coming months.

Velayutham noted that around half of India's shrimp farmers are likely to be re-stocking, as the situation improves and good Q3 demand is expected.

Meanwhile, in Ecuador, the US' third-largest source of shrimp, responsible for 17% of the imports in March, the nation's shrimp capital of Guayadil has seen a dramatic climb in COVID cases and is an epicenter for the virus. Also, the shrimp farmgate prices have fallen so low in Ecuador -- between $0.10 and $0.50 per kilogram for the latest harvest -- that many small producers fear bankruptcy.

Raw material price levels were at $3.60/kg for 30-40 count shrimp; $3.20/kg for 40-50 count; $3.00/kg for 50-60; $2.80/kg for 60-70 count; and $2.40/kg for 70-80 count.

"We are selling our shrimp at or even below production costs. If the situation continues like this, it will drive many of us completely into bankruptcy," an industry representative who spoke on condition of anonymity from Manabi, told Undercurrent.

China also faces low farm-gate prices and additionally is expected to confront shortage due to a local outbreak of decapod iridescent virus 1, known as shrimp hemocyte iridescent virus in shrimp, as reported earlier by Undercurrent.

Other news

- A recovery for the shrimp market? 17/04/2024

- Shrimp market: Fear of inflation and declining demand 22/10/2022

- Summer demand remains strong in the United States of America and Europe 08/11/2021

- Global supply chains are being battered by fresh COVID surges 18/08/2021

- Animal Health and Welfare in Aquaculture 17/08/2021

- Pangasius Imports Outpacing Tilapia 10/08/2021

- Growth in India's Shrimp Production and Exports 08/08/2021

- Decline in shrimp exports to China makes shrimps cheaper in India for domestic market 03/08/2021

- Rabobank sees plenty of positives for both shrimp and salmon sectors 29/07/2021

- Asia’s Shrimp Connoisseurs: Japan, Taiwan And South Korea 02/07/2021