King of shrimp industry profits in 2023

A shrimp company suddenly rose to dominate the industry's profits, with a sudden EPS of nearly 70,000 VND, book value of 370,000 VND/share, and 100% dividend/year.

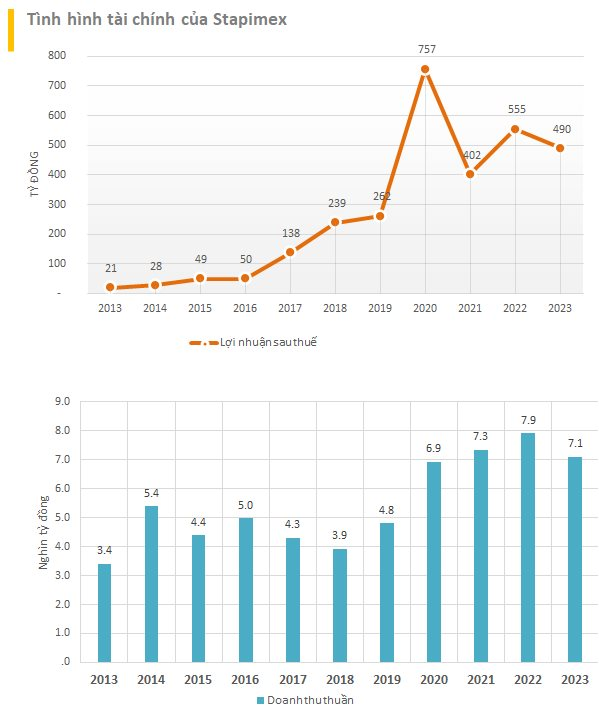

Previously, in 2020, Stapimex also surpassed the 'shrimp king' to become the largest profitable shrimp enterprise with a net profit of 757 billion VND, 1.2 times higher than Minh Phu.

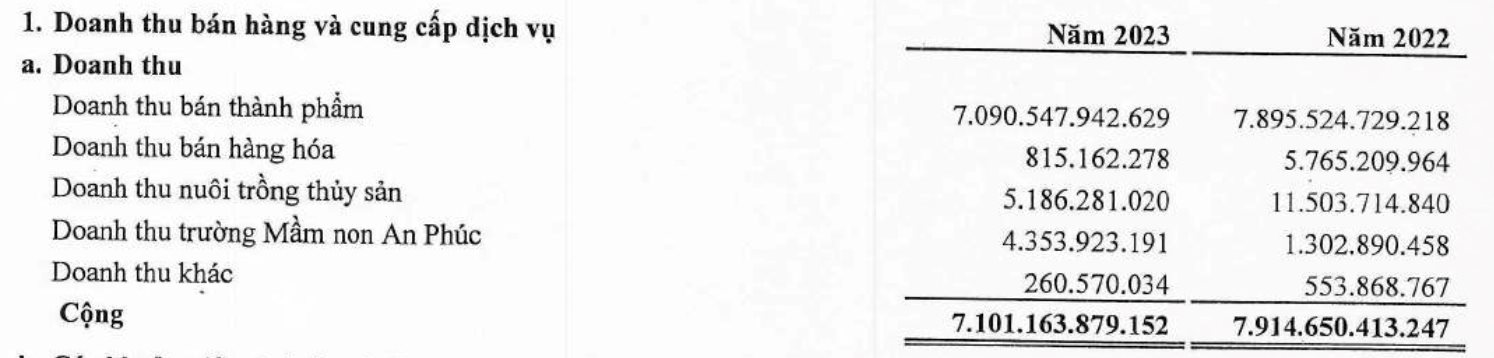

The 2023 audited financial statements of Soc Trang Seafood Joint Stock Company (Stapimex) recorded that the Company's revenue last year reached 7,101 billion VND - a decrease of 10% compared to last year.

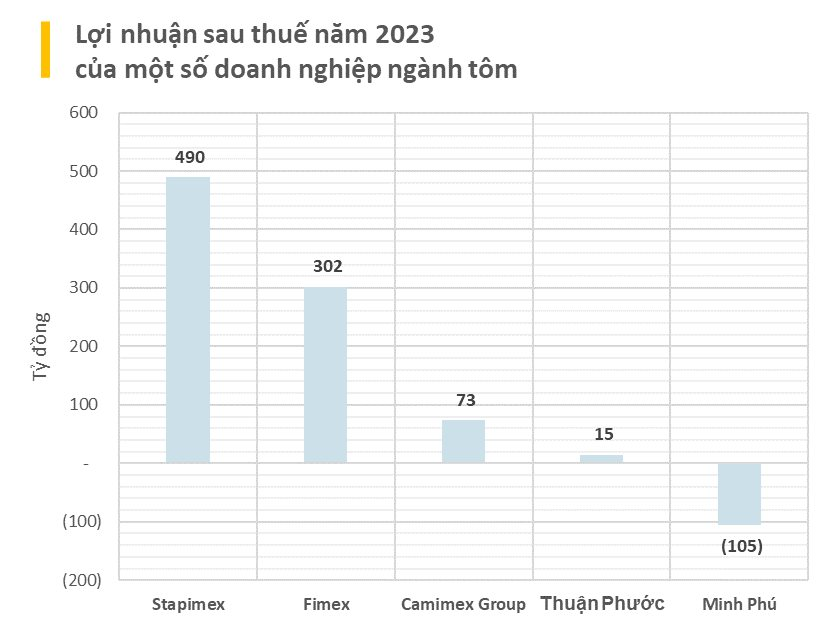

Although costs were significantly reduced, especially sales costs decreased by 50% over the same period, profit after tax still decreased by 12% to VND 490 billion.

By the end of 2023, Stapimex's charter capital is only 77.5 billion VND, equity capital is 2,613 billion VND, accumulated in undistributed after-tax profits (more than 995 billion VND), capital surplus (more than 109 billion) and Development Investment Fund (VND 1,453 billion).

Total assets reached 2,616 billion VND, of which cash and cash equivalents suddenly increased 65.5 times higher than at the beginning of the period to 785 billion VND. Stapimex has always been famous as a company that does not borrow long-term loans. Last year, the Company sharply increased short-term loans to supplement business capital.

Despite a decline due to difficult market conditions, 2023 is the year Stapimex once again surpasses "shrimp king" Minh Phu to rise to the Top 1 in industry profits. Previously, in 2020, Stapimex surpassed Mr. Le Van Quang's Minh Phu Group to become the largest profitable shrimp enterprise with a net profit of 757 billion VND, 1.2 times higher than Minh Phu (617 billion VND) and 3.3 times Fimex VN (225 billion VND).

Meanwhile, last year, Minh Phu suddenly reported a loss of 105 billion VND.

In fact, in terms of seafood, compared to Minh Phu, Stapimex possesses many superior financial indicators because this enterprise does not pursue the model of building large farming areas, only purchasing for processing.

If Minh Phu owns a farming area of thousands of hectares, a feed factory and seed production area with a closed model, Stapimex only has a farming area of only 70 hectares. Sharing on Forbes Vietnam, Mr. Ta Van Vung, General Director of Stapimex said that the Company only focuses on purchasing raw materials for processing. Mr. Vung explained this because he did not have the resources to build a farming area, food, or breed, nor did he have the conditions for a large land area to do so.

In addition to the 70ha farming area mentioned above, about 40% of the input materials for Stapimex's two factories come from links with six cooperatives with a cooperative area of 500 hectares. The remaining 60% is purchased externally.

Stapimex also has an EPS "surpassing" the group of businesses in the same industry on the floor with 70,000 VND.

With equity of 2,613 billion VND on 7 million outstanding shares, book value (BV) per share is up to nearly 370,000 VND.

Stapimex also has a tradition of paying cash dividends at a high rate. For 6 consecutive years from 2015 to 2019, Stapimex paid cash dividends at a rate of 50%. In the period 2020 - 2022, this number will increase to 100%.

Tri Tuc

Source: cafef.vn

Other news

- Early stocking to get good price 21/12/2024

- Shrimp prices rise again in Vietnam, and reach 12-month high in India 28/08/2024

- Vietnamese Shrimp Industry Faces Many Challenges: Farmers Prefer Quality but Cheap Shrimp Seeds 01/08/2024

- Raw shrimp prices fall: Another challenge the shrimp industry must overcome 03/07/2024

- Storms in the shrimp industry may last in 2024 07/05/2024

- Vietnam's Seafood Exports Reach $2 Billion In Q1 03/04/2024

- A difficult story for shrimp 11/03/2024

- Shrimp exports face a difficult problem 23/02/2023

- Vietnam’s shrimp exports reached 141 million USD in the first month of 2023 22/02/2023

- SEABINAGROUP CONTRIBUTES TO LOCAL COMMUNITY 13/01/2023