Global shrimp performance in 2019

Global shrimp performance in 2019

Written by: Richard Nguyen - Seabina Co.,Ltd

Reference source: Shrimp tail magazine #9 and Richard Nguyen added his understandings about Viet Nam shrimp industry

Export volume: + 6.45%

Export value: - 1.16%

China export: - 23.77%

Thailand export: - 5.63%

Argentina export: - 10.77%

Bangladesh export: -1.41%

Ecuador export: + 26.33%

India export: + 8.36%

Indonesia export: +5.81%

Viet Nam export: not applied

General situation of shrimp industry in early 2020

Jan, Feb/20: China was heavily hit by Covid-19 when the pandemic early started in Wuhan, other countries are still normal

Mar/20: the pandemic spread globally caused the demand strongly declined and made the prices of shrimp dropped dramatically and farmers did not stock much

- India: farmers reduced stocking due to Covid-19, however; India can quickly supplies when the market strong again thank to the ready inventory and new harvesting

- Viet Nam: export markets shrunk, especially EU decreased 40%, US & China also decreased so the scenario of strong supply and low demand could happen

- Indonesia: prices of shrimp declined due to the pandemic in China & US, however; farmers still stocked much and will mainly harvest in May, 2020

- Bangladesh: farmers stocked black tiger in early Mar/20 and prices of black tiger were stable in Mar/20. But the prices dropped in Apr/20 because of low demand, Bangladesh heavily sells to wholesalers and foodservices in EU, right now most of EU countries are being lockdown and restaurants are closed so the consumption of black tiger shrimp sharply

- Ecuador: shrimp export to China dramatically dropped in Feb/20 due to the pandemic in China but the country quickly shifted to export to US & EU and made the great growth 32% year-on-year increase in Feb/20 with the export volume of 59,873 tons. By late Mar/20, most of SME packers are closed and other larger packers are still producing but the production decreased 70%, the outlook for the coming months is highly uncertain

Situation of shrimp industry of each country

1/ Ecuador

+ As predicted, the production volume in 2020 would be 700,000 tons. However, with the current situation of the pandemic and low demand in globe so that this aim should be uncertain

+ Jan/20: Ecuador exported 49,796 tons, a 23% year-on-year increase compared to Jan/19

+ Feb/20: export decreased in volume to China where the pandemic was happening, but the data export still showed a 32% year-on-year growth with total export volume of 59,873 tons thank to shifting export to US & EU

+ Average price of Vannamei:

- Nov/19: $5.94/kg

- Dec/19: $5.77/kg

- Jan/20: $5.69/kg

- Feb/20: $5.58/kg

Further drop price would be expected in Mar – Apr/20, these are farmegate prices of Vannamei

30-40 con: 3.60 usd/kg

40-50 con: 3.20 usd/kg

50-60 con: 3.00 usd/kg

60-70 con: 2.80 usd/kg

70-80 con: 2.40 usd/kg

+ in Apr/20, demand from China comes back but Ecuador is facing the pandemic domestically and being lockdown some parts of country. With the current pandemic in the country and in the globe, it is difficult for farmers who can’t sell their shrimp, SMEs reduced production or co-packing with larger companies, for large-scale companies they are delaying in investment or building of new farms or buying established facilities

+ the coming months of Ecuadorian shrimp industry is still uncertain, and many experts have given two possible scenarios:

- 1st scenario: US & EU buyers will take advantage of low prices to stock and waiting for the pandemic ends but soon, the export to EU & US would slow down if the pandemic hasn’t controlled soon

- 2nd scenario: China demand would be strong again and even Chinese buyers would pay higher to purchase Ecuadorian shrimp when Chinese local market bounces back in the coming months

+ Ecuadorian market share in 2019

- China: 50.6%

- US: 12.4%

- EU: 18.5%

- Viet Nam: 9.5%

- Other Asia: 2.3%

- Other markets: 6.7%

Export volume: 633,890 tons

Export value: $3.655 millions

2/ India

+ early 2019, Indian farmers faced difficult with diseases and floods. However, India still showed the top shrimp producer in 2019 with total export: 667,140 tons, a 8.43% growth compared with 2018

+ the first half 2019: the export volume lagged behind 2018 but the send half 2019 the export volume increased approximately 25% each month thank to the delay the first crop which peaked in June and July, particularly big sizes

+ Oct-Nov/19 were the peak growth 35% and 40% respectively compared with 2018. This large increases in export were the result of crops stocked in Aug and Sep being harvested and India shipped a lot to three main markets: China, US, EU for end year holiday. In Dec/19, the demand relieved and Indian farmers faced with diseases and hard weather conditions lead to early harvesting and made prices dropped

+ Jan/20 was the quiet month because of low demand from main market and also low harvest for the winter crop

+ Feb-Mar/20: Indian farmers prepared ponds to stock again favorably, however; the Covid-19 pandemic quickly spread to EU, US and other countries then the demand dropped leading to export of Indian shrimp has consequently slowed down

+ end Mar/20: the country put on lockdown until mid Apr that made stocking has been hold on 15-20% down in Gujarat and 45-50% down in West Bengal and Orissa

+ Average prices of Vannamei in West Bengal downed:

- 40 pcs/kg: $5.01/kg to $3.97/kg

- 60 pcs/kg: $3.65/kg to $3.18/kg

+ To stop the free fall of prices, Andhra Pradesh has agreed to set up minimum prices to shrimp products in an attempt to reassure farmers and prevent panic

+ Even China’s imports recently resumed but it is predicted Covi-19 will impact Indian shrimp exports through quarter 2 and beyond. At moment, Indian processors & exporters are still watching the global situation and using cold-storages to store shrimp

+ US foodservices are declining and retails are also suffering, shopping online is available but shrimp products are not main in shopping lists. Some US buyers take advantage of low prices to purchase and stock but this is also risky and unsustainable

+ The possibility, Covid-19 will largely affect to global trade of shrimp so that Indian farmers will presumably stock less during the normal summer crop

+ Indian market share in 2019

- US: 40%

- China: 25.3%

- EU: 11.2%

- Japan: 6.3%

- Viet Nam: 5%

- Other markets: 12.2%

Export volume: 667,141 tons

Export value: $4.899 millions

3/ Viet Nam

+ End year 2019 until before Tet holiday, prices of shrimp were relatively high due to the strong demand of main markets and low availability of raw material

+ After Tet holiday, the Covid pandemic started in China and made exports of shrimp and pangasius declined, especially pangasius heavily rely on China market. End Mar/20, the prices of shrimp dropped sharply when the pandemic spread globally and there were many rumors that factories do not stop buying shrimp and banks do not loan causing farmers panic and sold shrimp out unthinkably

+ According to the statistic figures, the shrimp production in two months of 2020 was estimated at 69,800 tons – a 4% year-on-year increase, the export volume of 2.5 months in 2020 reached more than 35,000 tons with a year-on-year increase 15%

+ The first half of Mar/20, the export volume to China showed a decline 31%, notably EU declined 40% due to the affection of the pandemic

+ Average prices for Vannamei:

- 30 pcs/kg: $5.81/kg to $5.72/kg

- 60 pcs/kg: $4.30/kg to $4.15/kg

- 100 pcs/kg: $3.31/kg to $3.22/kg

Similarly, prices of black tiger shrimp also dropped dramatically from mid till end of Mar. However, prices of shrimp slightly increased again in early Apr till now due to low supply of shrimp raw material in the market

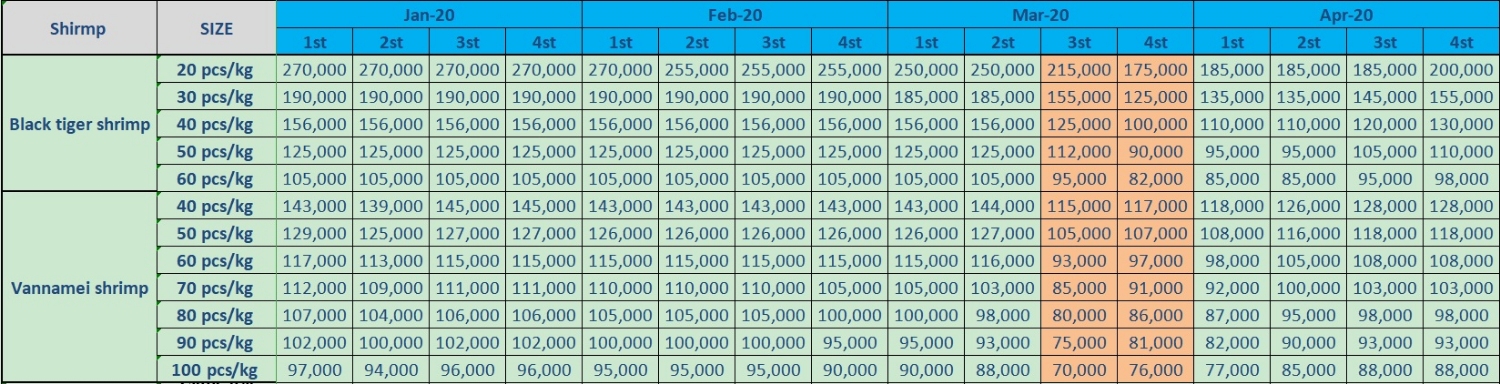

Progress of shrimp prices in Viet Nam in Jan-Apr/20 (vnd/kg)

+ Before, some predictions indicated that possibly prices of shrimp in Viet Nam will be further dropped in mid Apr - May because this period of time is the peak harvesting season, however; the reality showed the prices of shrimp are being uptrend and nobody really knows how many shrimp raw material available in ponds now, possibility is very low because farmers got panic with the pandemic and rumors before

+ Actually, many big factories like Minh Phu, Stapimex, Fimex… still aggressively buy shrimp for the current orders or taking advantage of low prices to store, because of the shortage of raw material now so those big factories often increase buying prices to collect raw material in the market

+ If main markets EU, US, China start to recover and demand consequently increases at the beginning of Q3 then export prices might suffer due to the high competition between producing countries India, Indonesia and Viet Nam already have a lot of shrimp stock and will be harvesting at that time

+ Viet Nam market share in 2019

- EU: 20.5%

- US: 19.5%

- Japan: 18.4%

- China: 16.2%

- Korea: 10%

- Other markets: 15.4%

Export volume: 316,890 tons

Export value: $3.380 millions

4/ Indonesia

+ Jan-Mar/20: Indonesian farmers struggled with diseases WFS (white feces syndrome) and WSS (white spot syndrome) in East/West Java and east coast of Lampung, WSS caused 90% farmers to stop their cultivation, at the same time farmers in North Java have losses in production as the peak of monsoon season started in Jan-Feb and forcing farmers to harvest earlier than expected

+ US is the largest market of Indonesian shrimp that consumed 133,130 tons in 2019, containing a third of Indonesia’s exports, followed by Japan and China. However; between Fed-Mar/20, the market is severely affected by the drop in demand from US and China due to Covid-19 pandemic, cold-storage companies are limiting their purchases from processors to clear stock gradually until prices recover

+ Average prices for Vannamei:

- 40 pcs/kg: $3.15/kg in Sulawesi and $3.76/kg in East Java, a drop - $1.84/kg in Sulawesi and -$1.72/kg in East Java respectively

- 100 pcs/kg: the price dropped not so severely like big sizes, just -$1.00/kg

+ Even dropping in prices but Indonesian farmers still stocked abundantly and will harvest in May coinciding with Ramadan month (Apr 23 to May 23) and Eid Al-Fitr celebration after. Possibly, Indonesian farmers might find farm gate prices be lower than they expected

+ Indonesia market share in 2019

- US: 66.4%

- Japan: 15.9%

- China: 5%

- Netherland: 1.3%

- UK: 1.4%

- Other markets: 10%

Export volume: 200,591 tons

Export value: $1.685 millions

5/ Bangladesh

+ Total export volume of Bangladeshi shrimp in 2019: 35,198 tons – a decrease of 1.4% compared to 2018

+ Total export value of Bangladeshi shrimp in 2019: $370 millions – a decrease of 3.45% compared to 2018

+ 2019 showed a year-on-year decrease of 1.6% in demand from European markets (Belgium, France, Germany Netherlands and UK), mainly accounted for by UK due to preparation of Brexit and lower global market prices

+ During the cultivation season of giant freshwater prawn which ended in Mar, prices of 20 pcs/kg remained stable, increase +$1.60/kg and +$2.20/kg for 5 and 10 pcs/kg respectively. However; end Mar the prices were decreasing again due to Covid-19 and end of cultivation season

+ Bangladeshi farmers prepared and stocked black tiger in early Mar and also experienced a drop in price

- 40 pcs/kg: $6.36/kg to $5.83/kg

- 20 pcs/kg: $10.76/kg to $10.39/kg

- 60 pcs/kg: relatively stable thank to domestic demand

+ Bangladesh shrimp heavily relies on EU markets where they sell shrimp to wholesalers and foodservices, but most of EU countries are being locked down now so that the demand is very low at this moment. If the situation does not improve then farmers could stock less or Bangladeshi exporters should find other markets like China or Japan to promote their shrimp products

+ Main harvesting season of black tiger in Bangladesh is from May to Oct, possibly price will drop to $5.00/kg for 40 – 70 pcs/kg at the first harvest begins that makes farmers to keep their shrimp in ponds to grow longer for larger sizes if the markets do not recover well

+ For giant freshwater prawn, farmers just stocked at mid-Apr and will harvest in June, depending on the demand of UK market (one of main markets of giant freshwater prawn) that drives the prices higher or lower. In 2019, prices of 5pcs/kg increased from $11.30/kg up to $14.4/kg and $5.83/kg up to $13.28/kg for 10pcs/kg

+ Bangladeshi market share in 2019

- Netherlands: 21%

- UK: 18.2%

- Germany: 17.5%

- Belgium: 13.2%

- France: 7.7%

- Japan: 4.1%

- US: 4.2%

- Other markets: 14.1%

Export volume: 35,198 tons

Export value: $370 millions

Please contact with Richard Nguyen if you have any ideas or comments

Email: giau@seabinagroup.com

Phone/Viber/Whatsapp/Line: +84.908.558.093

www.seabinagroup.com/en/

Other news

- A recovery for the shrimp market? 17/04/2024

- Shrimp market: Fear of inflation and declining demand 22/10/2022

- Summer demand remains strong in the United States of America and Europe 08/11/2021

- Global supply chains are being battered by fresh COVID surges 18/08/2021

- Animal Health and Welfare in Aquaculture 17/08/2021

- Pangasius Imports Outpacing Tilapia 10/08/2021

- Growth in India's Shrimp Production and Exports 08/08/2021

- Decline in shrimp exports to China makes shrimps cheaper in India for domestic market 03/08/2021

- Rabobank sees plenty of positives for both shrimp and salmon sectors 29/07/2021

- Asia’s Shrimp Connoisseurs: Japan, Taiwan And South Korea 02/07/2021